Investing mistakes to avoid

Welcome to the latest edition of our Insights.

Following the Government’s release of the Federal Budget, AMP economists Dr Shane Oliver, Diana Mousina and My Bui explain what impact the Federal Budget could have on the Australian economy and investment markets.

If you wish to discuss these topics, feel free to contact us.

All the best,

The Wealthy Me Team

Many measures were pre-announced, but key new measures include tax cuts from 2026-27 & more cost of living support.

While the revenue windfall is expected to continue, it’s mostly being spent on new measures resulting a return to deficit of $27.6bn this financial year and $42.1bn next year.

The Budget continues to lock in structurally higher spending and budget deficits for the medium term.

The ongoing high level of public spending risks higher than otherwise underlying inflation and weaker productivity.

Overall, it’s a pretty uninspiring Budget.

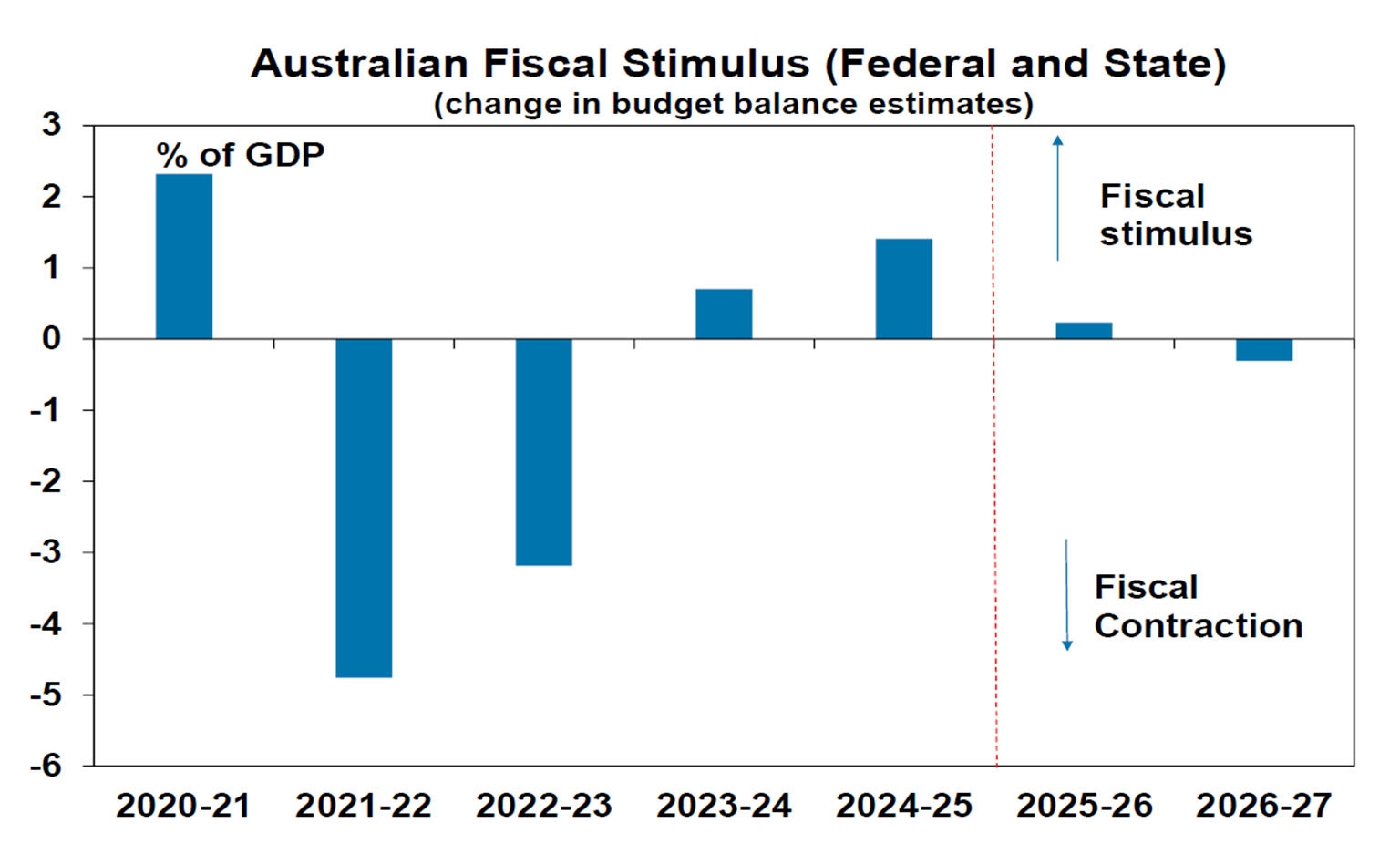

The Budget is aimed at three things: getting the government re-elected; providing more cost of living support; and talking and shoring Australia up ahead of Trump’s tariffs & trade wars impacting. It further cements bigger government and structural budget deficits for the medium term.

Key measures, most of which have already been announced, include:

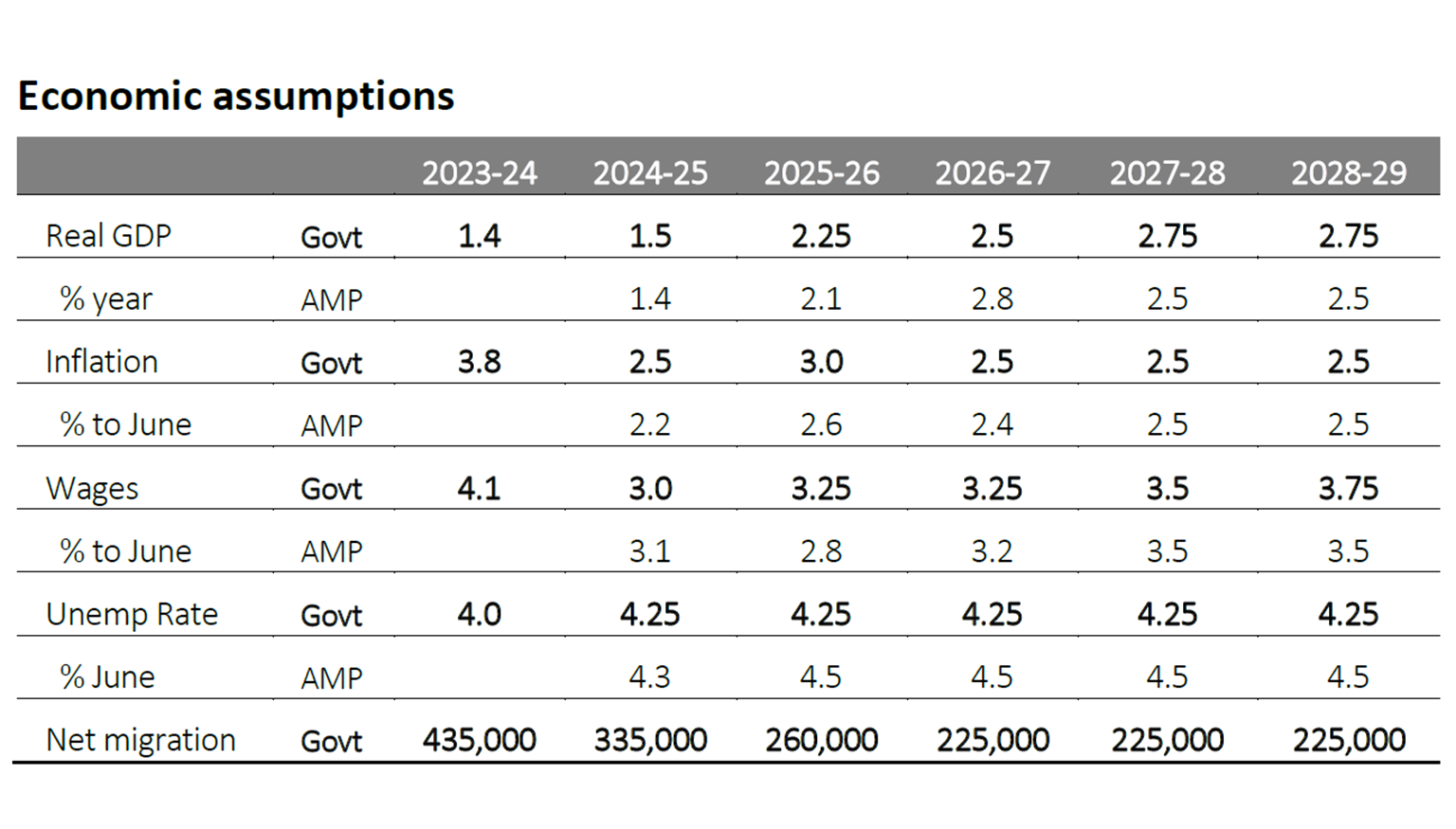

Despite increased global uncertainty associated with Trump’s tariffs – where the indirect impact on Australia from trade wars is seen as a far bigger risk than the direct impact of tariffs, the Government continues to expect a modest pick up in growth over the next few years. However, its sees inflation remaining in the 2-3% target range (helped this year by the latest cost of living measures will knock around 0.5% off inflation this year). Abstracting from the energy rebates it sees inflation around target from the middle of the year. It also revised down slightly its unemployment forecasts to 4.25%. The Government now sees net immigration of 335,000 this financial year (MYEFO was 340,000), falling to 225,000 in 2026-27, taking population growth down to around 1.2% from 2.4% in 2022-23. The Government kept its medium-term iron ore price assumption at $US60/tonne but pushed it out to March 2026. With iron ore well above that (~$US100 as of March 2025), it’s still a source of revenue upside.

Source: Australian Treasury, AMP

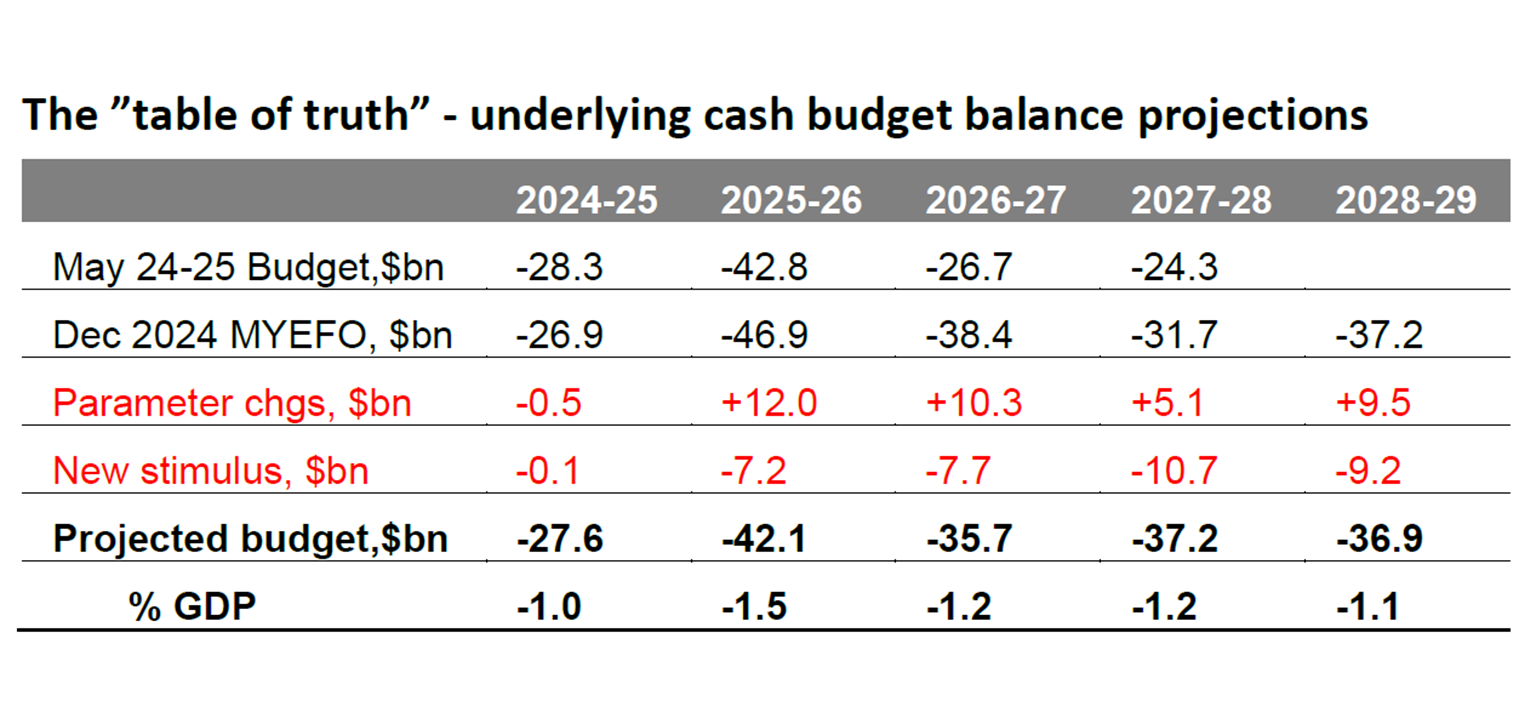

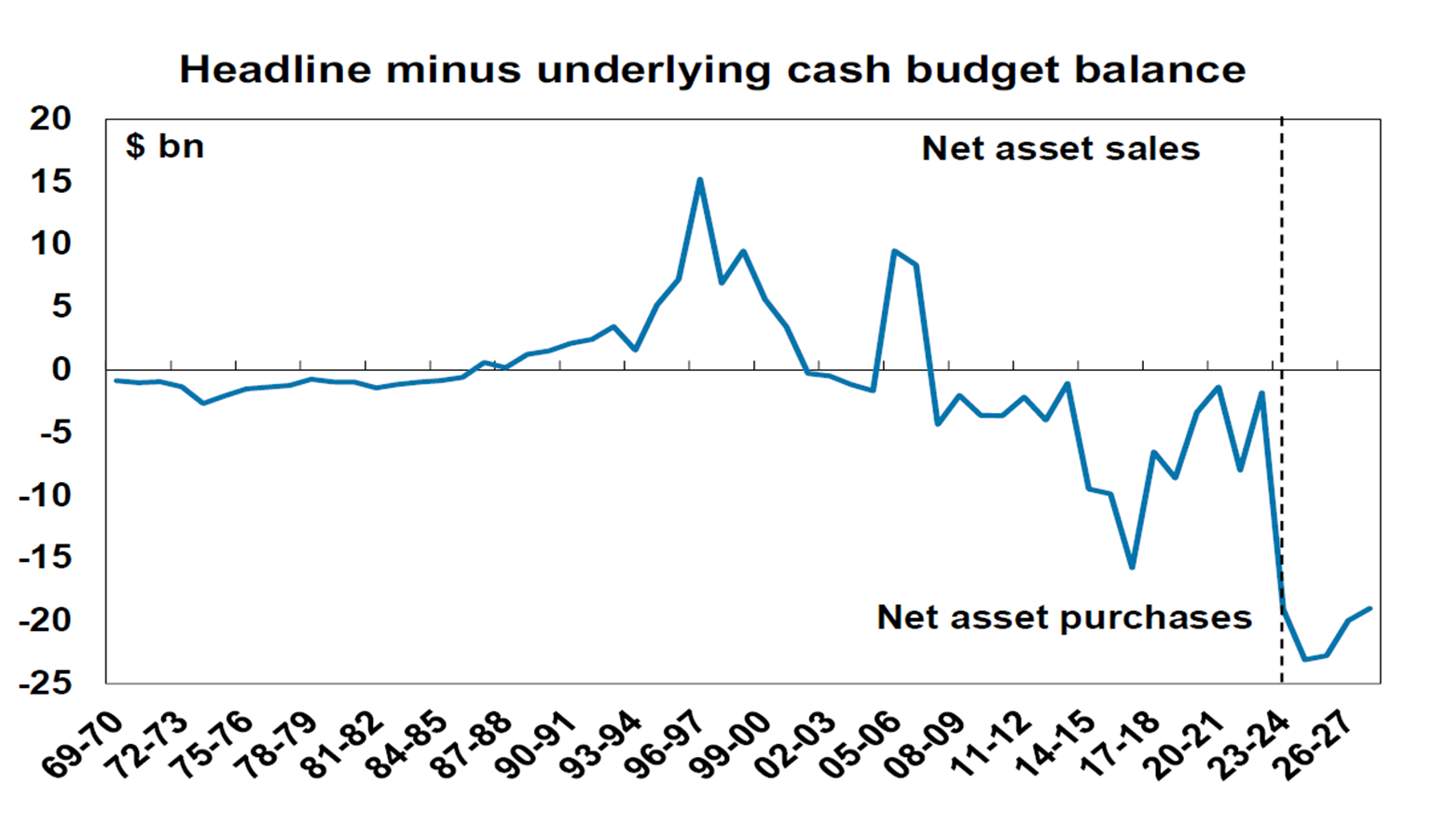

While it’s not forecast for this year, the Government is again benefitting from extra revenue flows coming from higher personal tax due to stronger jobs growth and higher commodity prices (and hence mining profits) than assumed. This is not smart management but good luck flowing from conservative forecasts. This is what gave us the surpluses in 2022-23 and 2023-24 of $22bn and $16bn. But the windfall is diminishing and in the face of another round of extra spending is seeing a return to deficits. The windfall can be seen in the next table (called “parameter changes”) and is estimated to reduce the deficit over the five years to 2028-29 by $36.4bn. But this table – nicknamed the “table of truth” – also shows how much of the windfall has been spent (see the “new stimulus” line) and in this Budget it totals $34.9bn over five years. So 96% of the windfall is being spent leaving in place the forecast return to budget deficits.

Source: Australian Treasury, AMP

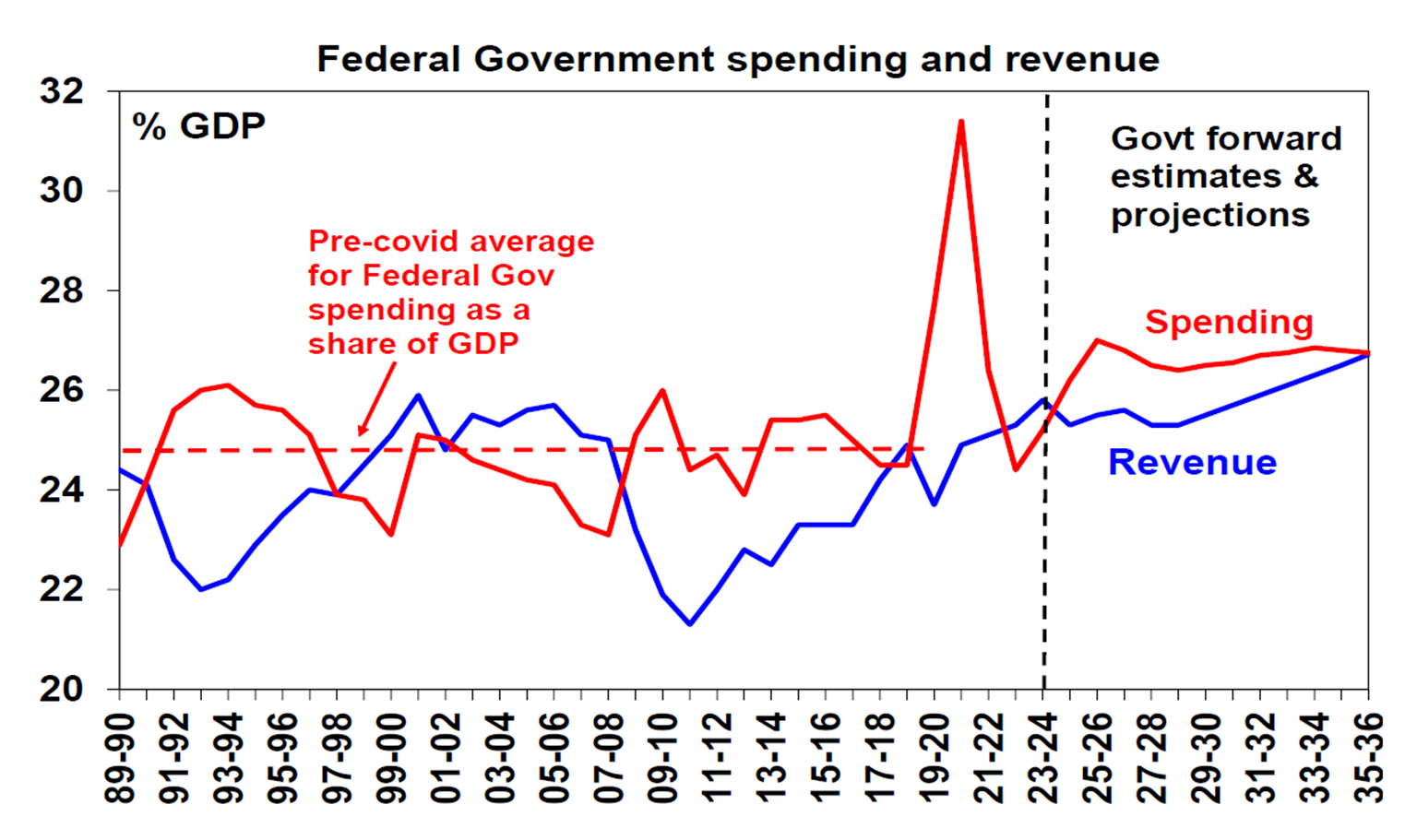

Due to new spending & structural pressures from interest costs, the NDIS, defence, health and aged care, spending as a share of GDP is expected to average 26.7% over the longer term, well above the pre-Covid average of 24.8%. Despite another blip down with mini tax cuts, revenue starts trending up from 2028-29 reaching a record 26.7% of GDP in a decade as bracket creep kicks in again. So bracket creep, not spending restraint is still assumed to do the work in getting us back to balance.

Source: Australian Treasury, AMP

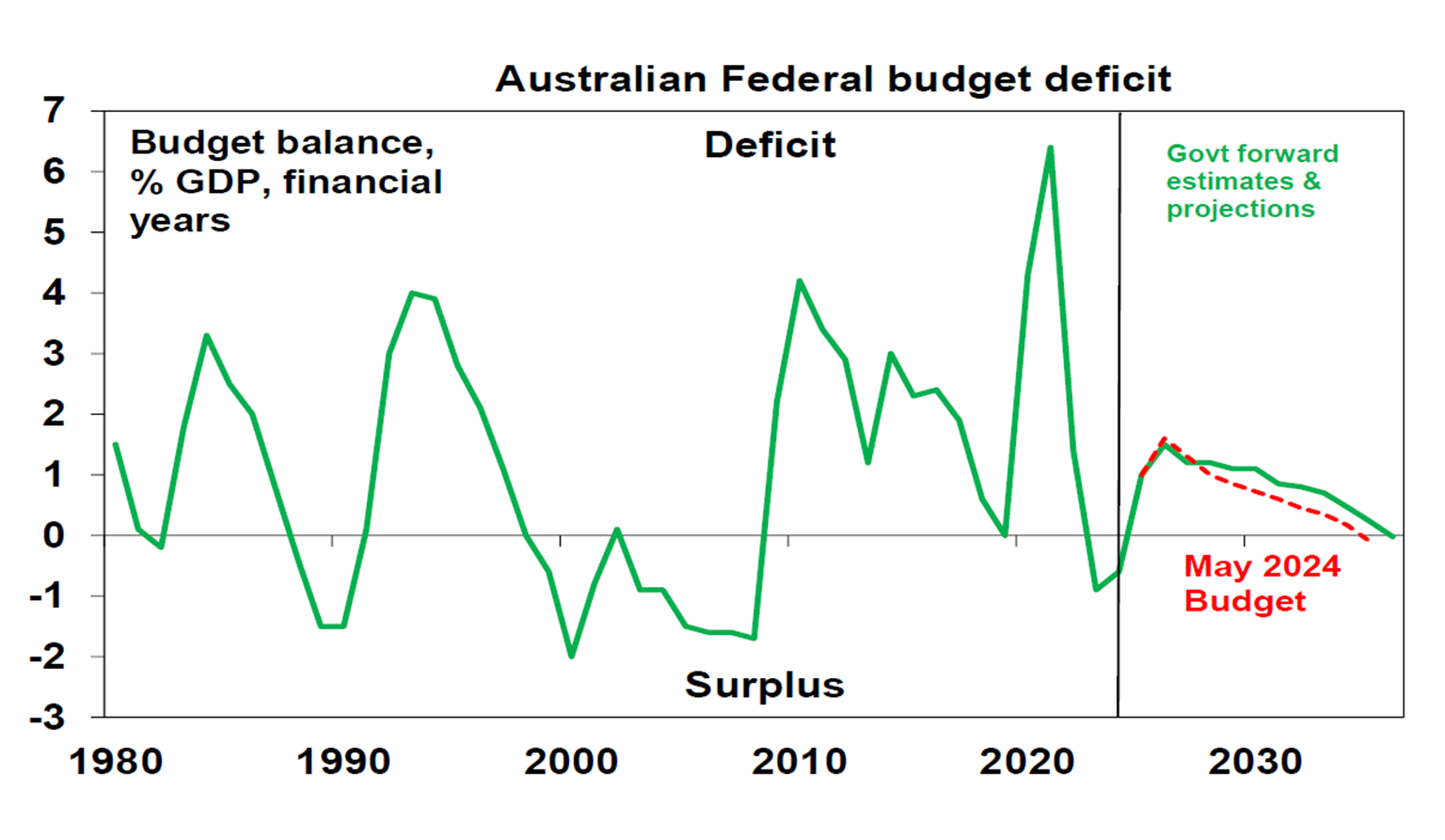

After two surpluses we are now back into deficits for the next decade.

Source: Australian Treasury, AMP

Gross public debt of $940bn or 34% of GDP is projected to rise above $1trn in 2025-26 and reach 37% of GDP by 2028-29 before trending down.

Winners include: households; tax payers; pensioners; beer drinkers; medicine users; low income renters; home builders; “lucky” first home buyers who get Help to Buy; and local manufacturing. Losers include: tax evaders, scammers & consultants with more measures to curtail them.

The positives include: new tax cuts giving back some bracket creep; more cost of living measures helping keep headline inflation down; Australia’s deficit & debt in better shape than most OECD countries; and more scope for revenue to surprise higher with cautious commodity price assumptions.

However, the Budget has several significant weaknesses in relation to:

Source: Australian and state treasuries, AMP

Source: Australian Treasury, AMP

While the cost of living measures will keep headline inflation down, the RBA will focus on underlying inflation and here the ongoing rise in government spending is making its job harder. But it’s probably not enough to change our forecasts for more rate cuts this year.

Cash and term deposits – cash and deposit returns have likely peaked with RBA cutting rates – the Budget may keep them higher than otherwise.

Bonds – medium term deficits put upward pressure on bond yields, but they are roughly as expected so there is not much in it.

Shares – the Budget is positive for spending and hence retail shares, but this may be offset by higher than otherwise rates. Some manufacturers may benefit from subsidies. Overall, it looks neutral for shares.

Property – the housing measures are unlikely to alter the home priceoutlook. We see modest home price growth this year.

The $A – the Budget is unlikely to change the direction for the $A.

Dr Shane Oliver, Head of Investment Strategy and Chief Economist, AMP

Diana Mousina, Deputy Chief Economist, AMP

My Bui, Economist, AMP

If you have any questions about the Budget measures announced, please don’t hesitate to contact us.